Data Science Solutions for Retail Strategy to Reduce Waste Keeping High Profit

Abstract

:1. Introduction

1.1. Background

1.2. Literature Review on Food Waste Reduction

1.3. Literature Review on Stock Management and Demand Estimataion

1.4. The Aim and Contribution to the Literature

2. Methods

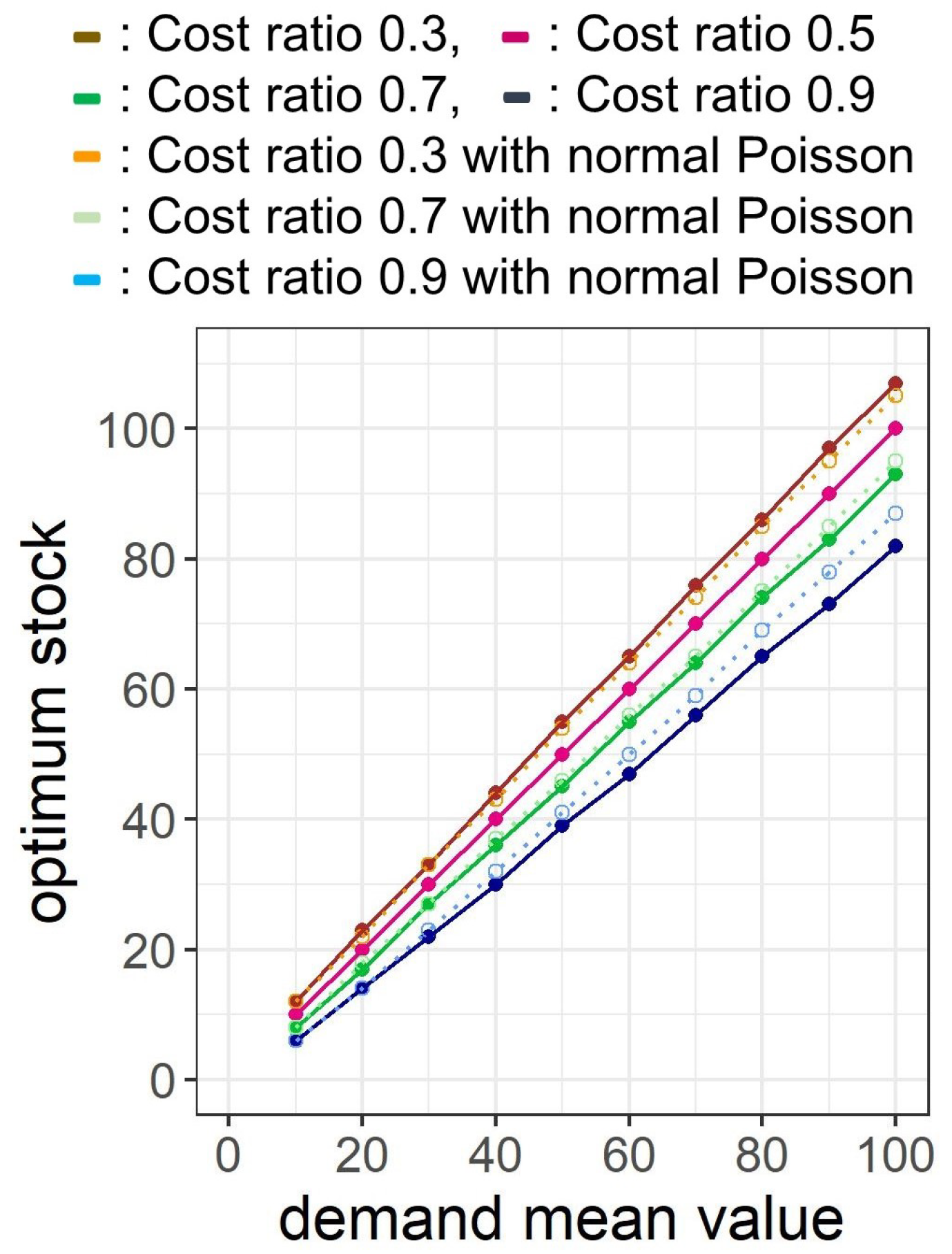

2.1. Newsvendor Problem

2.2. Assumption of the Demand Distribution

2.3. Parameter Estimation of the Demand Distribution

2.4. Pricing the Cost of Waste Reduction

2.5. Stock Determination for Fine Control of Waste Reduction

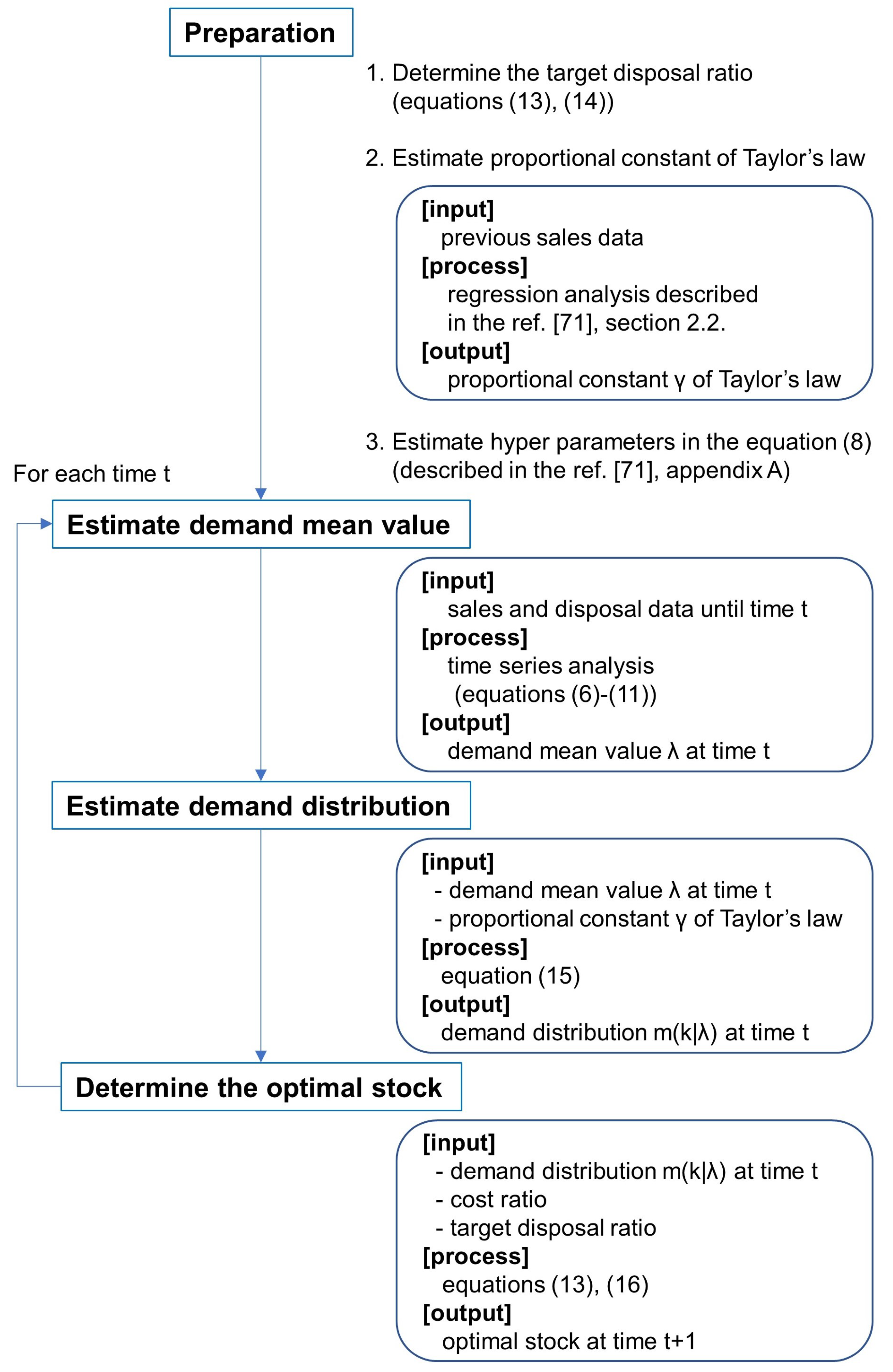

2.6. Summary of the Procedure to Determine the Stock

- Set time . The initial stock needs to be determined empirically. In this research, is calculated with the Equation (13) using sales value for simplicity.

- Observe the sales and disposal of a product at time t. In the case of sold-out, the observed sales is the same value as the stock .

- Specify the demand distribution at the day t with the Equation (15).

- Inclement and go back to step 3.

2.7. Point-Of-Sales (POS) Data

3. Results

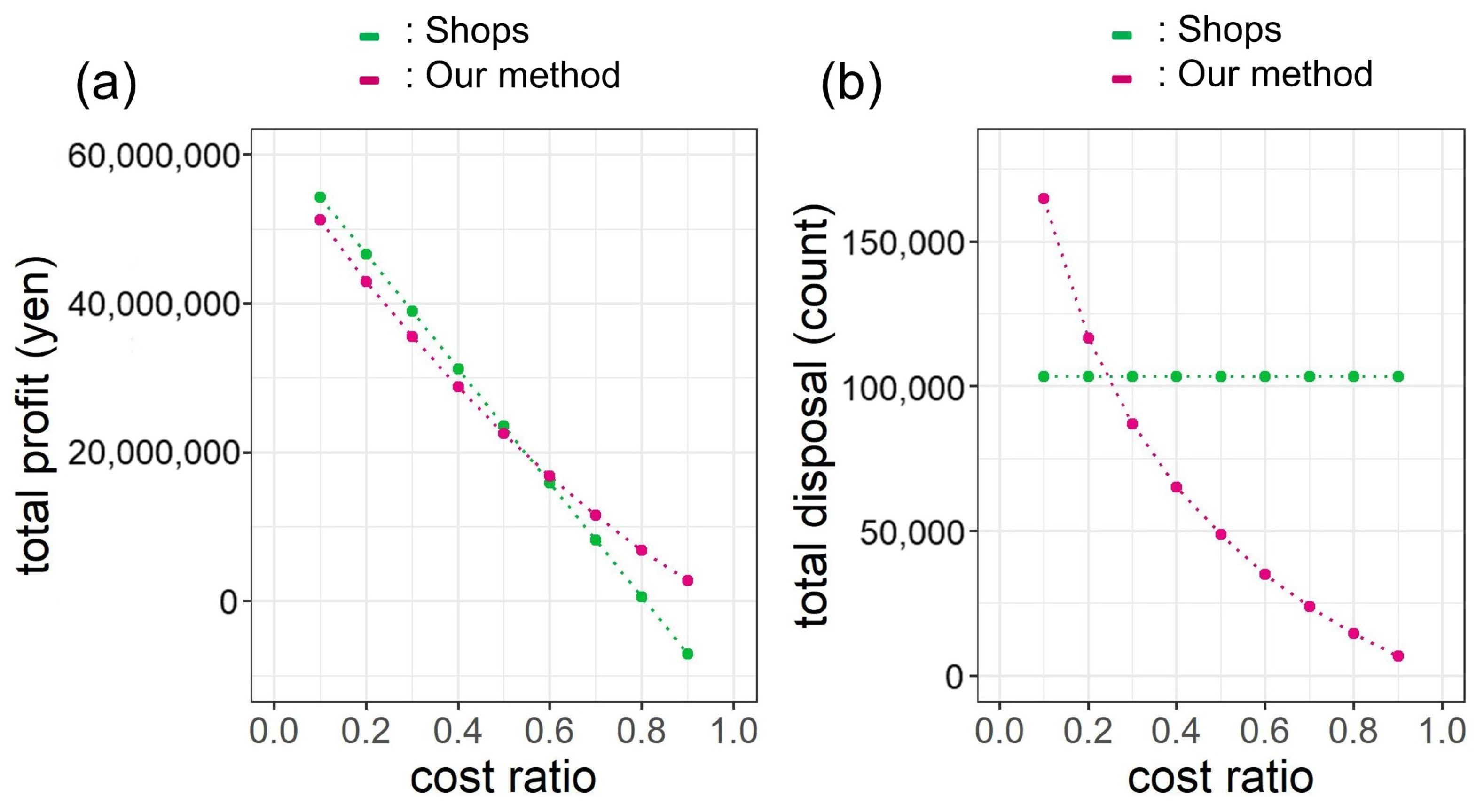

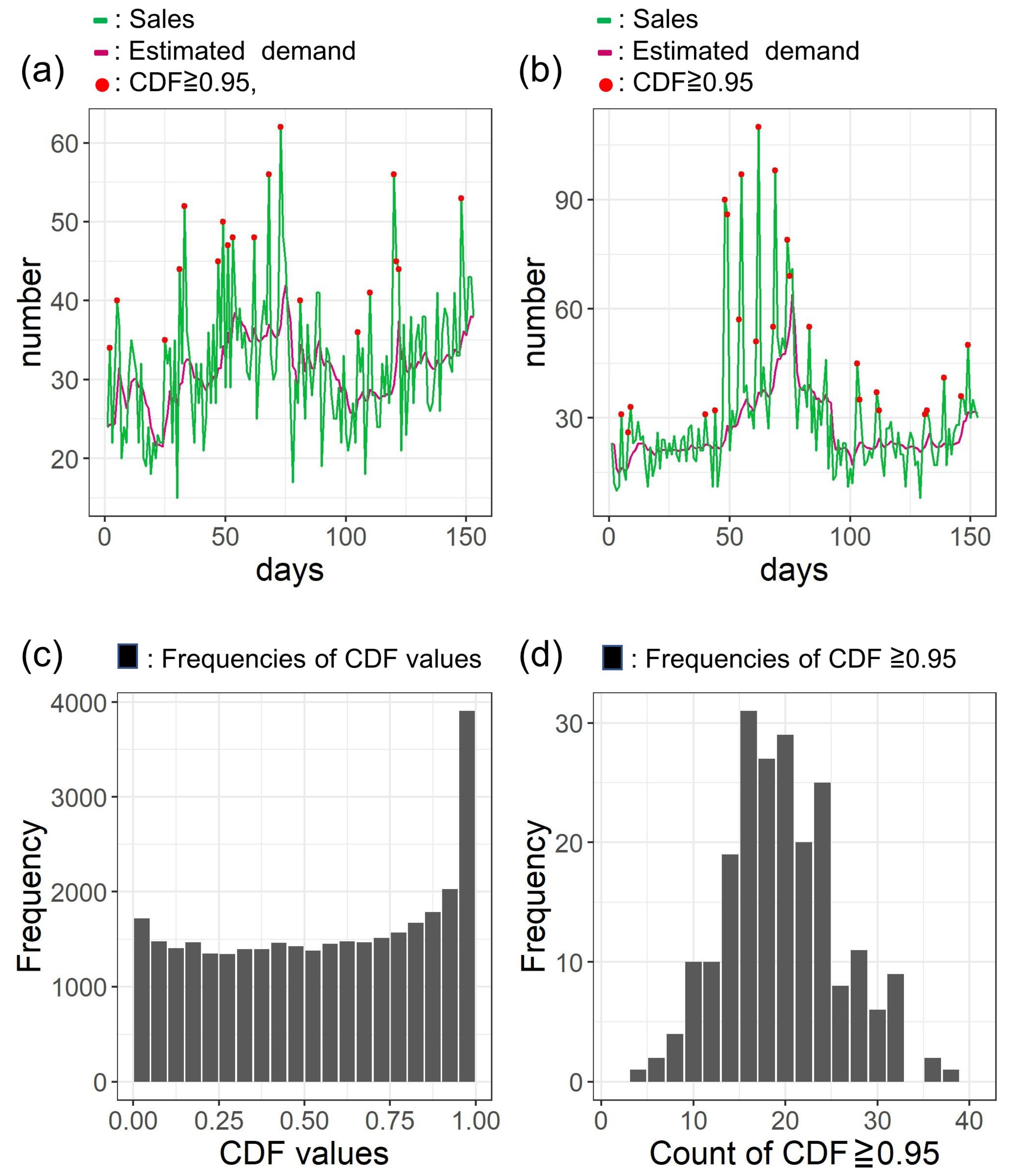

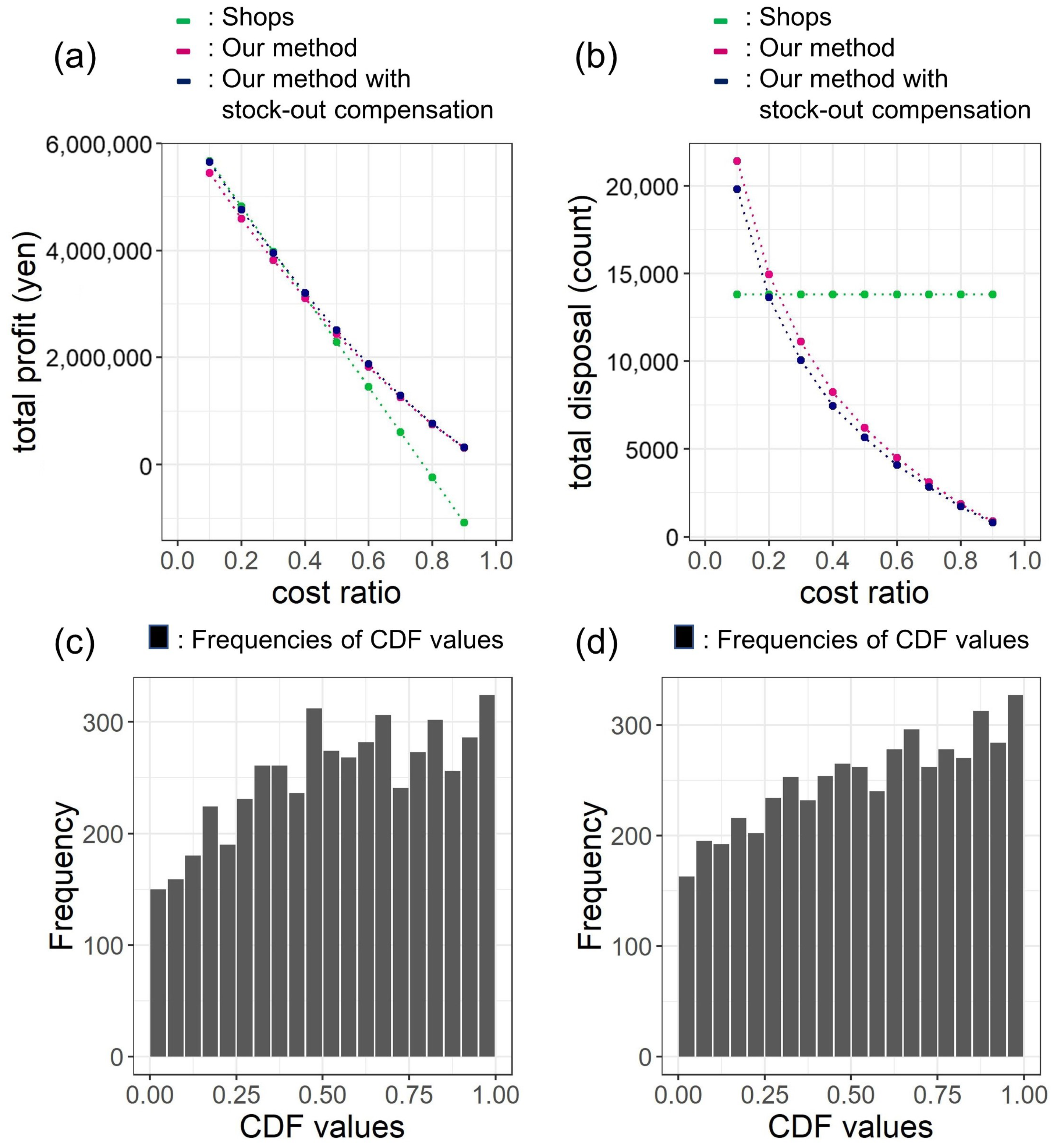

3.1. Optimal Stock Determination Using POS Data

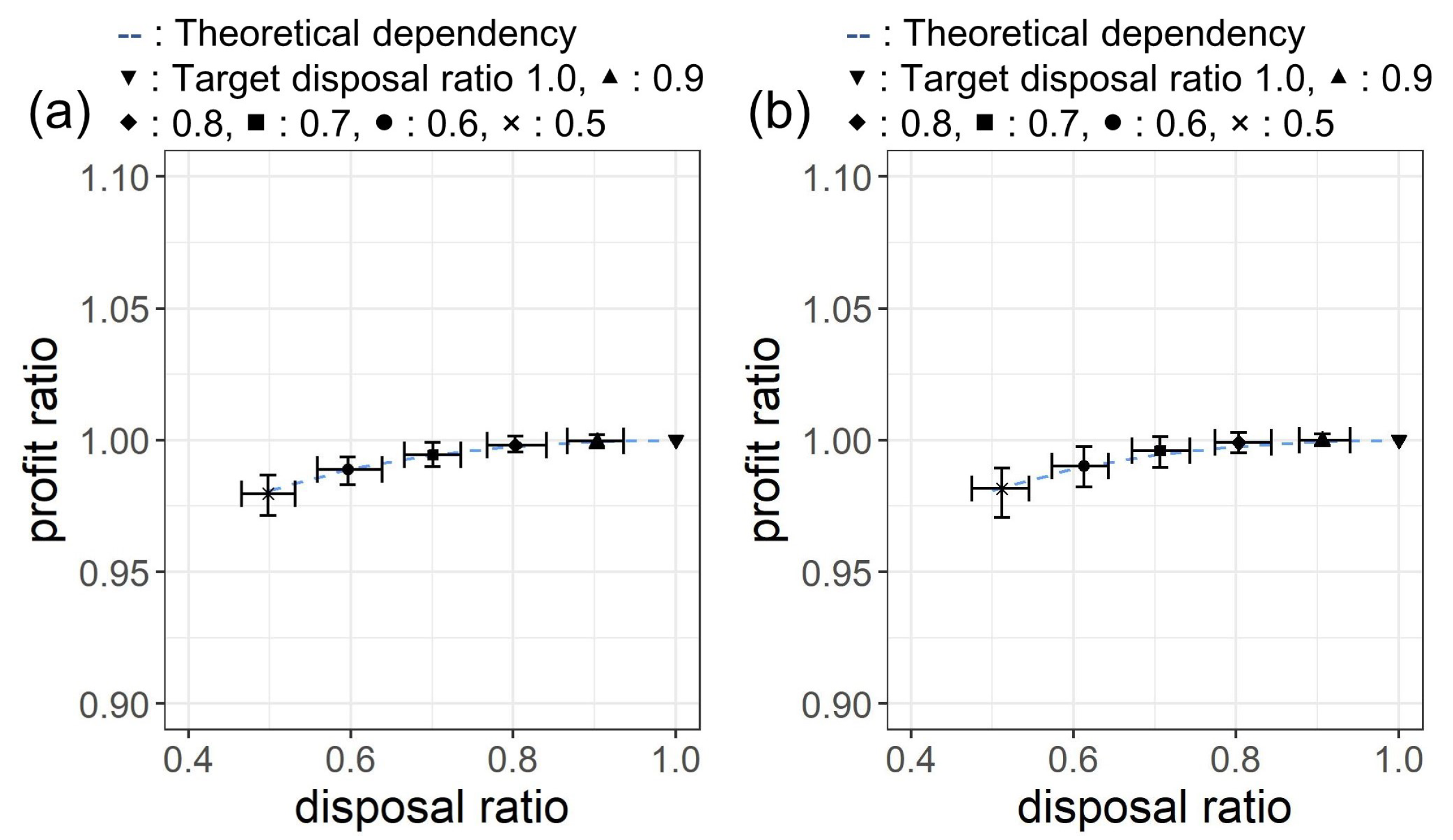

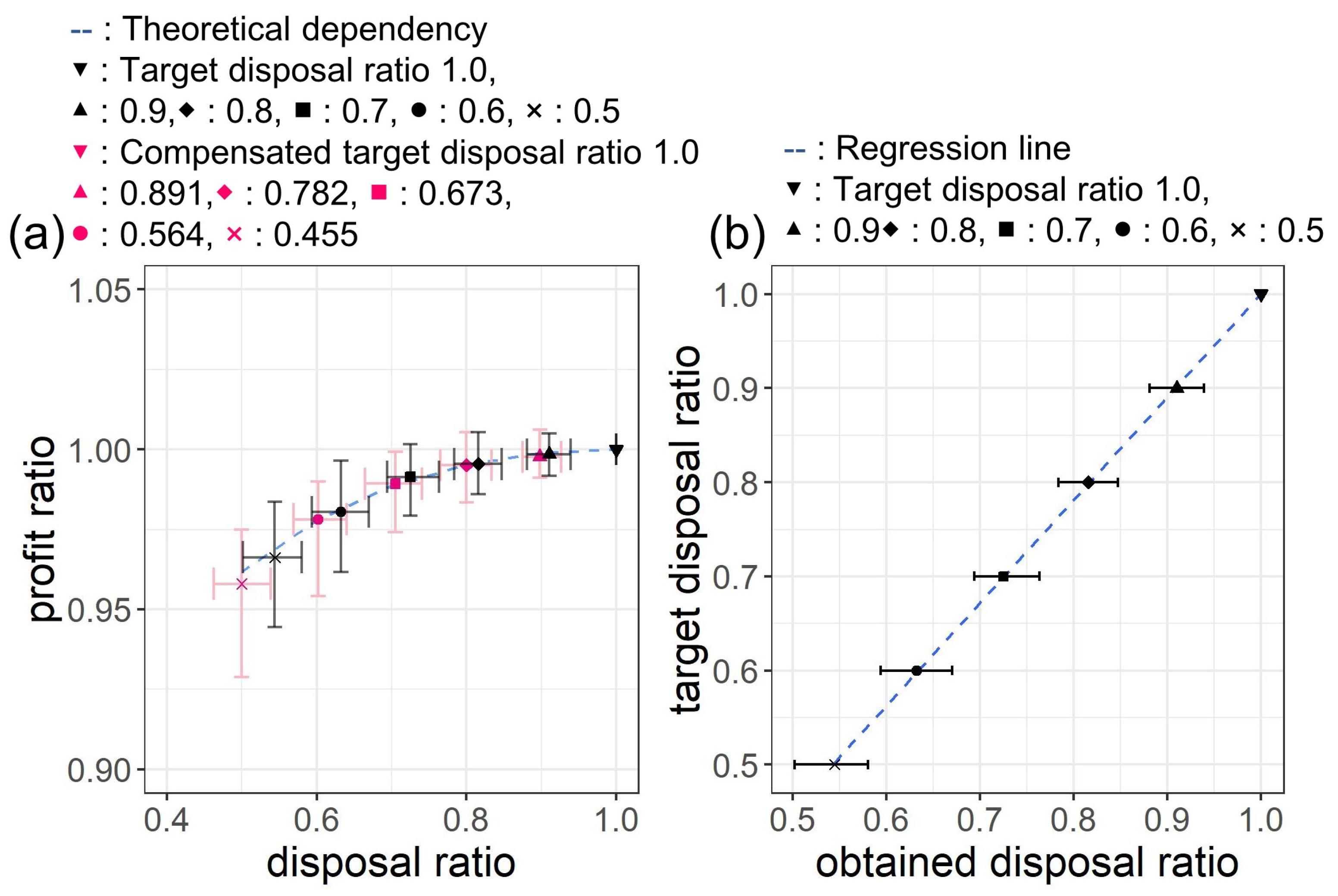

3.2. Further Waste Reduction

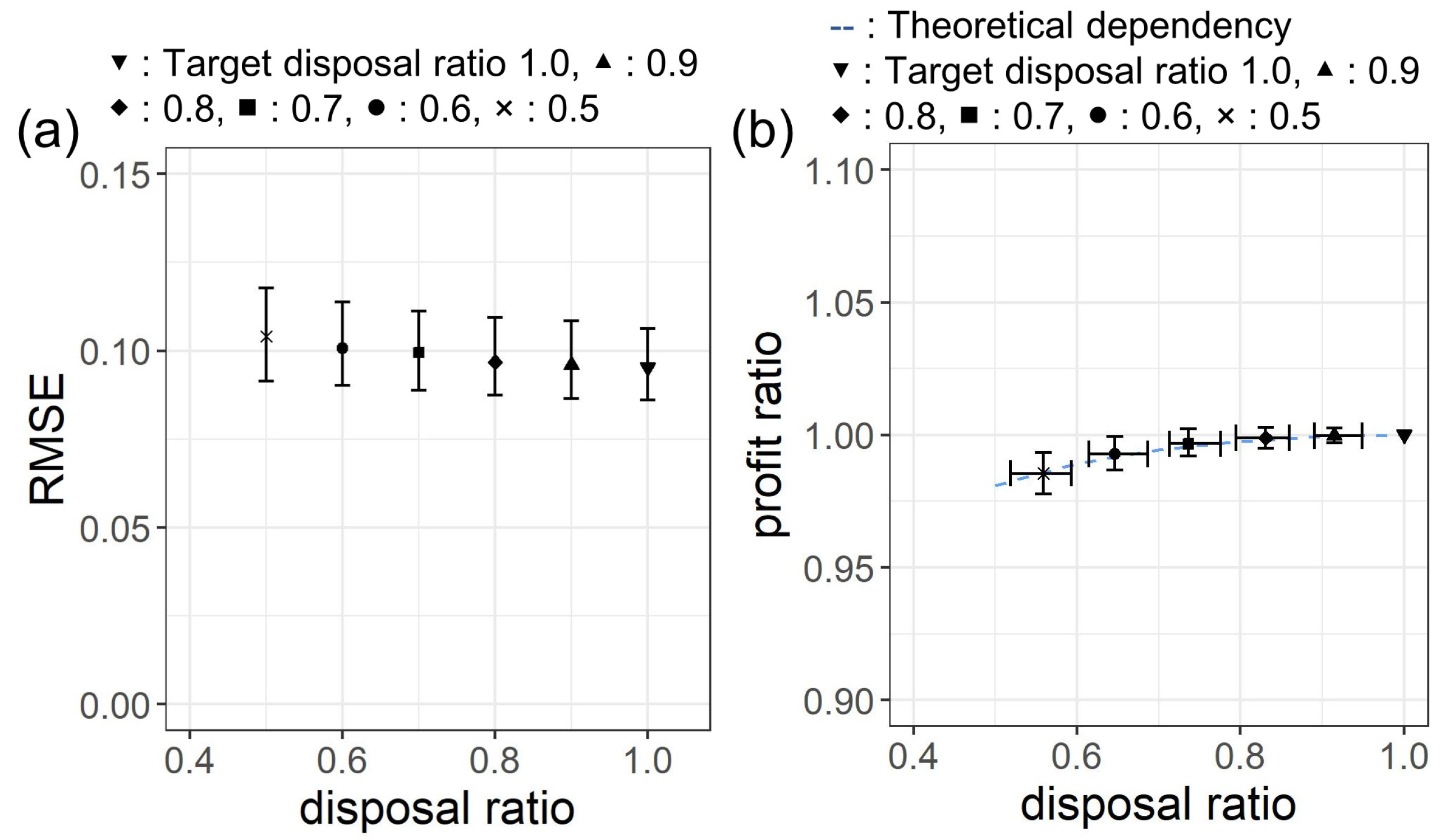

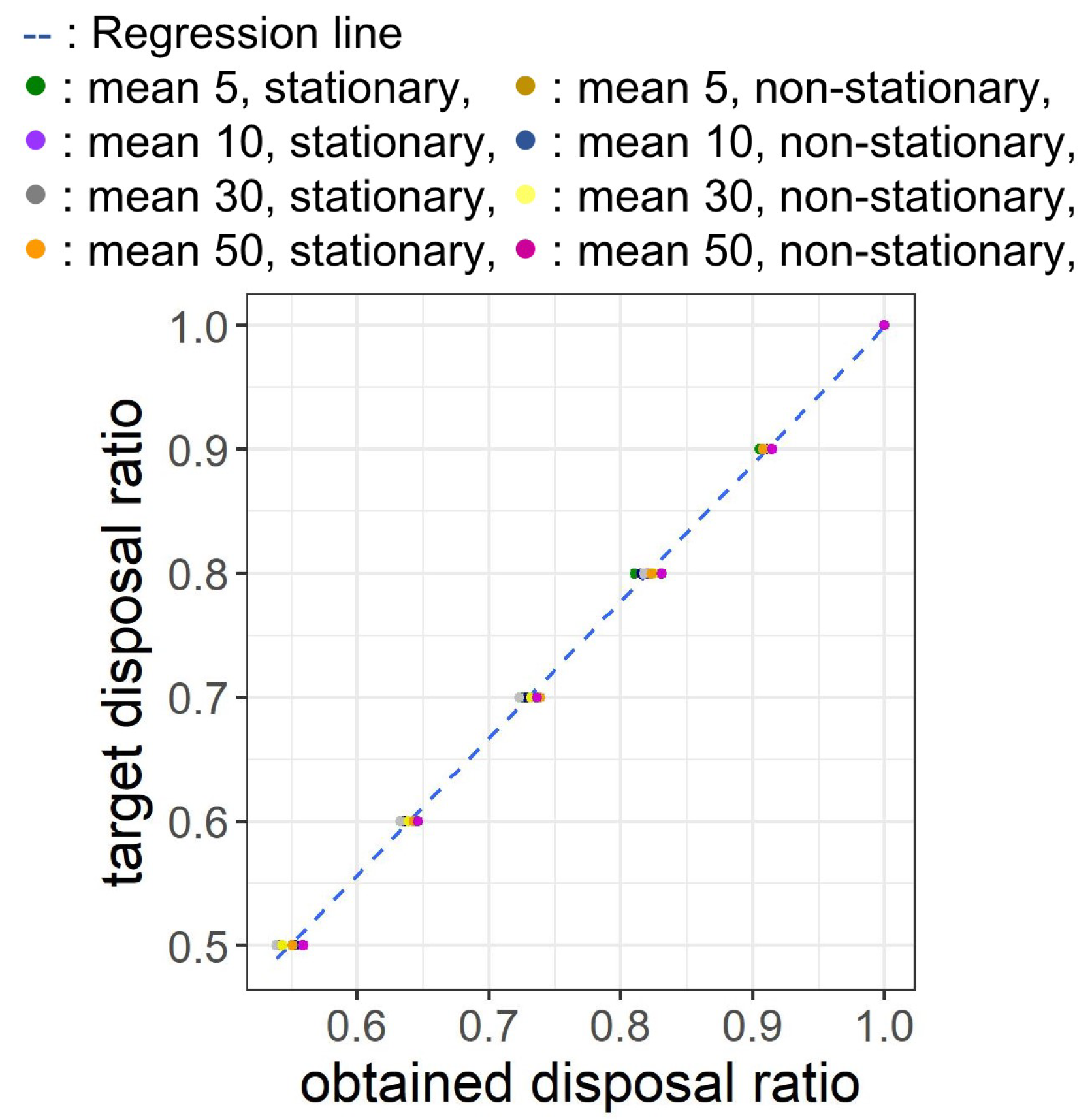

3.3. Detailed Examination on Our Method

4. Discussion

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

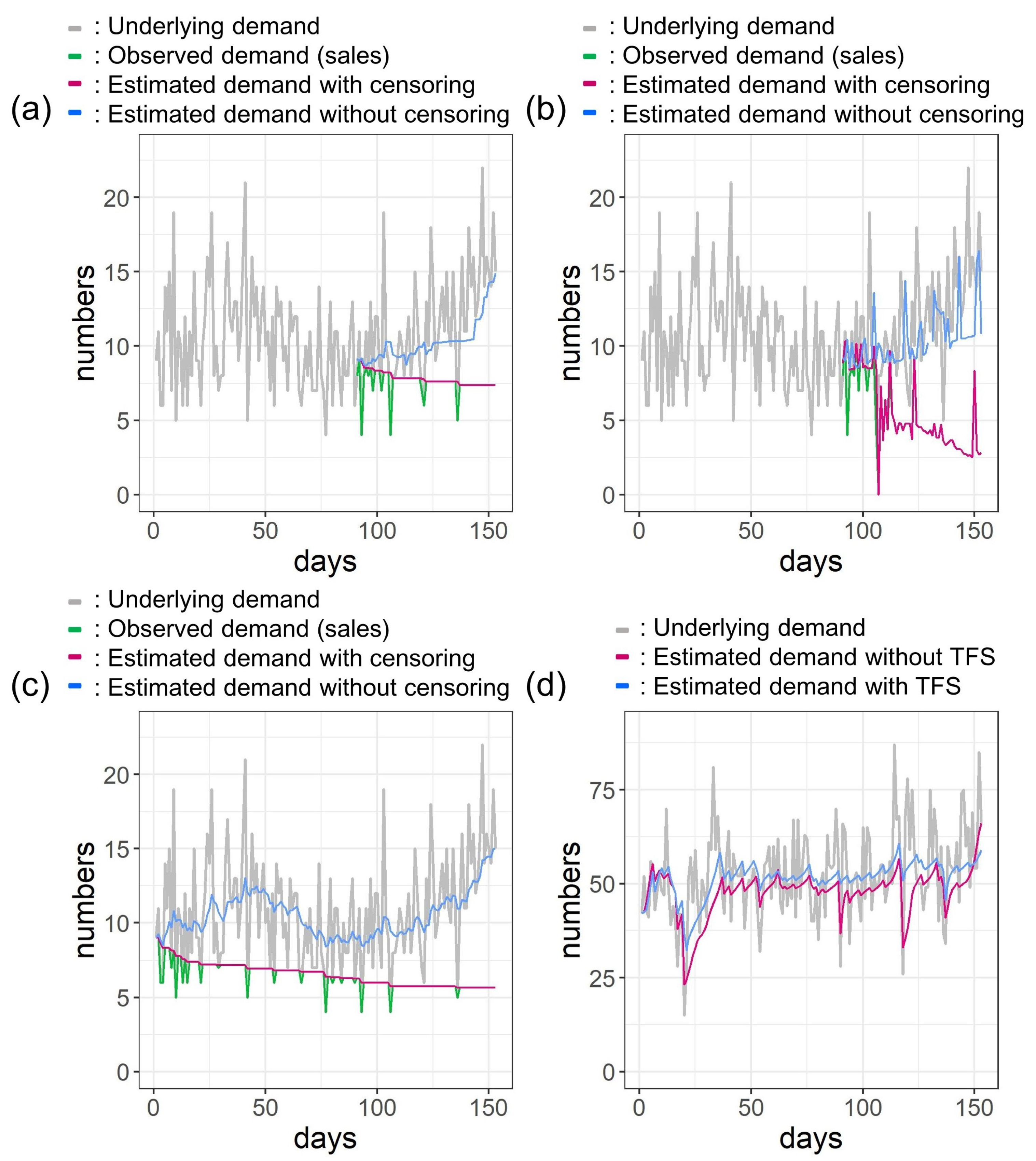

Appendix A. Verification of Our Method with Artificial Time Series

References

- World Population Prospects the 2017 Revision; United Nations: New York, NY, USA, 2017.

- Food Wastage Footprint—Impacts on Natural Resources; Food and Agriculture Organization of the United Nations: Rome, Italy, 2013.

- Global Food Security Index 2014 Special Report: Food Loss and Its Intersection with Food Security; The Economist Intelligence Unit: London, UK, 2014.

- Stancu, V.; Haugaard, P.; Lähteenmäki, L. Determinants of consumer food waste behaviour: Two routes to food waste. Appetite 2016, 96, 7–17. [Google Scholar] [CrossRef] [PubMed]

- Lindgren, E.; Harris, F.; Dangour, A.D.; Gasparatos, A.; Hiramatsu, M.; Javadi, F.; Loken, B.; Murakami, T.; Scheelbeek, P.; Haines, A. Sustainable food systems—A health perspective. Sustain. Sci. 2018, 13, 1505–1517. [Google Scholar] [CrossRef] [PubMed]

- Transforming Our World: The 2030 Agenda for Sustainable Development; United Nations: New York, NY, USA, 2015.

- FUSIONS. Estimates of European Food Waste Levels. Available online: http://www.eu-fusions.org/phocadownload/Publications/Estimates%20of%20European%20food%20waste%20levels.pdf (accessed on 19 June 2019).

- Goldenberg, S. From Field to Fork: the Six Stages of Wasting Food. Available online: https://www.theguardian.com/environment/2016/jul/14/from-field-to-fork-the-six-stages-of-wasting-food (accessed on 19 June 2019).

- Estimates of Food Surplus and Waste Arisings in the UK. Available online: http://www.wrap.org.uk/sites/files/wrap/Estimates_%20in_the_UK_Jan17.pdf (accessed on 19 June 2019).

- Global Food Losses and Food Waste; Food and Agriculture Organization of the United Nations: Rome, Italy, 2011.

- Katajajuuri, J.; Silvennoinen, K.; Hartikainen, H.; Heikkilä, L.; Reinikainen, A. Food waste in the Finnish food chain. J. Clean. Prod. 2014, 73, 322–329. [Google Scholar] [CrossRef]

- Brancoli, P.; Rousta, K.; Bolton, K. Life cycle assessment of supermarket food waste. Resour. Conserv. Recycl. 2017, 118, 39–46. [Google Scholar] [CrossRef]

- Mattsson, L.; Williams, H.; Berghel, J. Waste of fresh fruit and vegetables at retailers in Sweden—Measuring and calculation of mass, economic cost and climate impact. Resour. Conserv. Recycl. 2018, 130, 118–126. [Google Scholar] [CrossRef]

- Falcone, P.M.; Imbert, E. Bringing a Sharing Economy Approach into the Food Sector: The Potential of Food Sharing for Reducing Food Waste; Springer: Berlin/Heidelberg, Germany, 2017. [Google Scholar]

- Morone, P.; Falcone, P.M.; Imbert, E.; Morone, A. Does food sharing lead to food waste reduction? An experimental analysis to assess challenges and opportunities of a new consumption model. J. Clean. Prod. 2018, 185, 749–760. [Google Scholar] [CrossRef]

- Leftoverswap. Available online: http://leftoverswap.com/ (accessed on 19 June 2019).

- Foodsharing. Available online: https://foodsharing.de/ (accessed on 19 June 2019).

- Eatwith. Available online: https://www.eatwith.com/ (accessed on 19 June 2019).

- Feastly. Available online: https://eatfeastly.com/ (accessed on 19 June 2019).

- Galanakis, C. Sustainable Food Systems from Agriculture to Industry, 1st ed.; Elsevier: Amsterdam, The Netherlands, 2018; pp. 371–399. [Google Scholar]

- Lin, C.S.K.; Koutinas, A.A.; Stamatelatou, K.; Mubofu, E.B.; Matharu, A.S.; Kopsahelis, N.; Pfaltzgraff, L.A.; Clark, J.H.; Papanikolaou, S.; Kwan, T.H.; et al. Current and future trends in food waste valorization for the production of chemicals, materials and fuels: A global perspective. Biofuels Bioprod. Biorefin. 2014, 8, 686–715. [Google Scholar] [CrossRef]

- Love Food Hate Waste. Available online: https://www.lovefoodhatewaste.com/node/2343 (accessed on 19 June 2019).

- I Love Food. Available online: https://ivaluefood.com/ (accessed on 19 June 2019).

- Filimonau, V.; Gherbin, A. An exploratory study of food waste management practices in the UK grocery retail sector. J. Clean. Prod. 2017, 167, 1184–1194. [Google Scholar] [CrossRef] [Green Version]

- FareShare. Fighting Hunger, Tackling Food Waste. Available online: http://www.fareshare.org.uk (accessed on 19 June 2019).

- Food Cloud. Available online: http://food.cloud/ (accessed on 19 June 2019).

- ASDA and the Environment. Available online: https://www.asda.com/environment (accessed on 19 June 2019).

- Food Labelling Terms. Available online: http://www.nhs.uk/Livewell/Goodfood/Pages/food-labelling-terms.aspx (accessed on 19 June 2019).

- Heikkilä, L.; Reinikainen, A.; Katajajuuri, J.M.; Silvennoinen, K.; Hartikainen, H. Elements affecting food waste in the food service sector. Waste Manag. 2016, 56, 446–453. [Google Scholar] [CrossRef]

- Martin-Rios, C.; Demen-Meier, C.; Gössling, S.; Cornuz, C. Food waste management innovations in the foodservice industry. Waste Manag. 2018, 79, 196–206. [Google Scholar] [CrossRef] [Green Version]

- Morone, P.; Falcone, P.M.; Lopolito, A. How to promote a new and sustainable food consumption model: A fuzzy cognitive map study. J. Clean. Prod. 2019, 208, 563–574. [Google Scholar] [CrossRef]

- Porteus, E.L. Stochastic Inventory Theory. Handbooks in Operations Research and Management Science; Elsevier: Amsterdam, The Netherlands, 1990; Volume 2, pp. 605–652. [Google Scholar]

- Khouja, M. The single-period (news-vendor) problem: Literature review and suggestions for future research. Omega 1999, 27, 537–553. [Google Scholar] [CrossRef]

- Qin, Y.; Wang, R.; Vakharia, A.J.; Chen, Y.; Seref, M.M.H. The newsvendor problem: Review and directions for future research. Eur. J. Oper. Res. 2011, 213, 361–374. [Google Scholar] [CrossRef] [Green Version]

- Scarf, H.E. Bayes Solutions of the Statistical Inventory Problem. Ann. Math. Statist. 1959, 30, 490–508. [Google Scholar] [CrossRef]

- Scarf, H.E. Some remarks on bayes solutions to the inventory problem. Naval Res. Logist. Quart. 1960, 7, 591–596. [Google Scholar] [CrossRef]

- Azoury, K.S. Bayes Solution to Dynamic Inventory Models under Unknown Demand Distribution. Manag. Sci. 1985, 31, 1150–1160. [Google Scholar] [CrossRef]

- Conrad, S.A. Sales Data and the Estimation of Demand. Oper. Res. Q. 1976, 27, 123–127. [Google Scholar] [CrossRef]

- Wecker, W.E. Predicting Demand from Sales Data in the Presence of Stockouts. Manag. Sci. 1978, 24, 1043–1054. [Google Scholar] [CrossRef]

- Braden, D.J.; Freimer, M. Informational Dynamics of Censored Observations. Manag. Sci. 1991, 37, 1390–1404. [Google Scholar] [CrossRef]

- Lariviere, M.A.; Porteus, E.L. Stalking Information: Bayesian Inventory Management with Unobserved Lost Sales. Manag. Sci. 1999, 45, 346–363. [Google Scholar] [CrossRef]

- Lovejoy, W.S. Myopic Policies for Some Inventory Models with Uncertain Demand Distributions. Manag. Sci. 1990, 36, 724–738. [Google Scholar] [CrossRef]

- Chen, L. Bounds and Heuristics for Optimal Bayesian Inventory Control with Unobserved Lost Sales. Oper. Res. 2010, 58, 396–413. [Google Scholar] [CrossRef]

- Ding, X.; Puterman, M.L.; Bisi, A. The Censored Newsvendor and the Optimal Acquisition of Information. Oper. Res. 2002, 50, 517–527. [Google Scholar] [CrossRef] [Green Version]

- Lu, X.; Song, J.S.; Zhu, K. Analysis of Perishable-Inventory Systems with Censored Demand Data. Oper. Res. 2008, 56, 1034–1038. [Google Scholar] [CrossRef] [Green Version]

- Besbes, O.; Chaneton, J.; Moallemi, C.C. The Exploration-Exploitation Tradeoff in the Newsvendor Problem. SSRN Electron. J. 2017, 14–61. [Google Scholar] [CrossRef]

- Burnetas, A.N.; Smith, C.E. Adaptive Ordering and Pricing for Perishable Products. Oper. Res. 2000, 48, 436–443. [Google Scholar] [CrossRef]

- Godfrey, G.A.; Powell, W.B. An Adaptive, Distribution-Free Algorithm for the Newsvendor Problem with Censored Demands, with Applications to Inventory and Distribution. Manag. Sci. 2001, 47, 1101–1112. [Google Scholar] [CrossRef] [Green Version]

- Huh, W.T.; Rusmevichientong, P. A Nonparametric Asymptotic Analysis of Inventory Planning with Censored Demand. Math. Oper. Res. 2009, 34, 103–123. [Google Scholar] [CrossRef]

- Huh, W.T.; Levi, R.; Rusmevichientong, P.; Orlin, J.B. Adaptive Data-Driven Inventory Control with Censored Demand Based on Kaplan-Meier Estimator. Oper. Res. 2011, 59, 929–941. [Google Scholar] [CrossRef] [Green Version]

- Chen, L.; Mersereau, A.J. Analytics for Operational Visibility in the Retail Store: The Cases of Censored Demand and Inventory Record Inaccuracy. International Series in Operations Research & Management Science; Springer: Berlin/Heidelberg, Germany, 2015; pp. 79–112. [Google Scholar]

- Song, J.S.; Zipkin, P. Inventory Control in a Fluctuating Demand Environment. Oper. Res. 1993, 41, 351–370. [Google Scholar] [CrossRef]

- Song, J.S.; Zipkin, P. Managing Inventory with the Prospect of Obsolescence. Oper. Res. 1996, 44, 215–222. [Google Scholar] [CrossRef]

- Sethi, S.P.; Cheng, F. Optimality of (s, S) Policies in Inventory Models with Markovian Demand. Oper. Res. 1997, 45, 931–939. [Google Scholar] [CrossRef]

- Treharne, J.T.; Sox, C.R. Adaptive Inventory Control for Nonstationary Demand and Partial Information. Manag. Sci. 2002, 48, 607–624. [Google Scholar] [CrossRef]

- Wang, Z.F.; Mersereau, A.J. Bayesian Inventory Management with Potential Change-Points in Demand. Prod. Oper. Manag. 2017, 26, 341–359. [Google Scholar] [CrossRef]

- Box, G.; Jenkins, G. Time Series Analysis: Forecasting and Control; Holden-Day: San Francisco, CA, USA, 1976. [Google Scholar]

- Reyman, G. State reduction in a dependent demand inventory model given by a time series. Eur. J. Oper. Res. 1989, 41, 174–180. [Google Scholar] [CrossRef]

- Graves, S.C. A single-item inventory model for a nonstationary demand process. Manuf. Serv. Oper. Manag. 1999, 1, 174–180. [Google Scholar] [CrossRef]

- Carrizosa, E.; Olivares-Nadal, A.V.; Ramírez-Cobo, P. Robust newsvendor problem with autoregressive demand. Comput. Oper. Res. 2016, 68, 123–133. [Google Scholar] [CrossRef]

- See, C.T.; Sim, M. Robust Approximation to Multiperiod Inventory Management. Oper. Res. 2010, 58, 583–594. [Google Scholar] [CrossRef] [Green Version]

- Zhang, G.P. Neural Networks for Time-Series Forecasting, Handbook of Natural Computing; Springer: Berlin/Heidelberg, Germany, 2012; pp. 461–477. [Google Scholar]

- Ban, G.; Rudin, C. The Big Data Newsvendor: Practical Insights from Machine Learning. Oper. Res. 2019, 67, 90–108. [Google Scholar] [CrossRef] [Green Version]

- Tasaki, T.; Yamakawa, H. An estimation of the effectiveness of waste prevention by using point-of-sales (POS) data—The case of refills for shampoo and hair conditioner in Japan. Resour. Conserv. Recycl. 2011, 57, 61–66. [Google Scholar] [CrossRef]

- Doganis, P.; Alexandridis, A.; Patrinos, P.; Sarimveis, H. Time series sales forecasting for short shelf-life food products based on artificial neural networks and evolutionary computing. J. Food Eng. 2006, 75, 196–204. [Google Scholar] [CrossRef]

- Huber, J.; Gossmann, A.; Stuckenschmidt, H. Cluster-based hierarchical demand forecasting for perishable goods. Expert Syst. Appl. 2017, 76, 140–151. [Google Scholar] [CrossRef]

- Yang, C.L.; Sutrisno, H. Short-Term Sales Forecast of Perishable Goods for Franchise Business. In Proceedings of the 2018 10th International Conference on Knowledge and Smart Technology: Cybernetics in the Next Decades, Chiang Mai, Thailand, 31 January–3 February 2018; Volume 10, pp. 101–105. [Google Scholar]

- Lee, W.I.; Chen, C.W.; Chen, K.H.; Chen, T.H.; Liu, C.C. A comparative study on the forecast of fresh food sales using logistic regression, moving average and bpnn methods. J. Mar. Sci. Technol. 2012, 20, 142–152. [Google Scholar]

- Chen, C.Y.; Lee, W.I.; Kuo, H.M.; Chen, C.W.; Chen, K.H. The study of a forecasting sales model for fresh food. Expert Syst. Appl. 2010, 37, 7696–7702. [Google Scholar] [CrossRef]

- Kiil, K.; Hvolby, H.H.; Fraser, K.; Dreyer, H.; Strandhagen, J.O. Automatic replenishment of perishables in grocery retailing. Br. Food J. 2018, 120, 2033–2046. [Google Scholar] [CrossRef]

- Sakoda, G.; Takayasu, H.; Takayasu, M. Tracking Poisson Parameter for Non-Stationary Discontinuous Time Series with Taylor’s Abnormal Fluctuation Scaling. Stats 2019, 2, 55–69. [Google Scholar] [CrossRef]

- Taylor, L.R. Aggregation, variance and the mean. Nature 1961, 189, 732–735. [Google Scholar] [CrossRef]

- Fukunaga, G.; Takayasu, H.; Takayasu, M. Property of Fluctuations of Sales Quantities by Product Category in Convenience Stores. PLoS ONE 2016, 11, e0157653. [Google Scholar] [CrossRef]

- Agrawal, N.; Smith, S.A. Estimating Negative Binomial Demand for Retail Inventory Management with Unobservable Lost Sales. Naval Res. Logist. 1996, 43, 839–861. [Google Scholar] [CrossRef]

- Cherry, S.R.; Sorenson, J.A.; Phelps, M.E. Physics in Nuclear Medicine, 4th ed.; Elsevier: Amsterdam, The Netherlands, 2012; pp. 126–128. [Google Scholar]

- Harvey, A. Forecasting with Unobserved Components Time Series Models, Handbook of Economic Forecasting; Elsevier: Amsterdam, The Netherlands, 2006. [Google Scholar]

- Kitagawa, G. Monte Carlo Filter and Smoother for Non-Gaussian Nonlinear State Space Models. J. Comput. Graph. Stat. 1996, 5, 1–25. [Google Scholar]

- Gordon, N.J.; Salmond, D.J.; Smith, A.F.M. Novel approach to nonlinear/non-Gaussian Bayesian state estimation. IEE Proc. F 1993, 140, 107–113. [Google Scholar] [CrossRef] [Green Version]

- Lee, E.T.; Wang, J.W. Statistical Methods for Survival Data Analysis; WILEY: Hoboken, NJ, USA, 2013; pp. 133–205. [Google Scholar]

- Liu, J.S. Monte Carlo Strategies in Scientific Computing; Springer: Berlin/Heidelberg, Germany, 2001. [Google Scholar]

- Seven & i Holdings Co., Ltd. Corporate Outline 2011. Available online: https://www.7andi.com/library/dbps_data/_template_/_res/en/ir/library/co/pdf/2011_07.pdf (accessed on 29 May 2019).

- Hunter, J.S. The Exponentially Weighted Moving Average. J. Qual. Technol. 1986, 18, 203–210. [Google Scholar] [CrossRef]

- Akaike, H. A new look at the statistical model identification. IEEE Trans. Automat. Control 1974, 19, 716–723. [Google Scholar] [CrossRef]

- Kirchherr, J.; Piscicelli, L.; Bour, R.; Kostense-Smit, E.; Muller, J.; Huibrechtse-Truijens, A.; Hekkert, M. Barriers to the Circular Economy: Evidence From the European Union (EU). Ecol. Econ. 2018, 150, 264–272. [Google Scholar] [CrossRef] [Green Version]

- Mazzucato, M.; Semieniuk, G. Financing renewable energy: Who is financing what and why it matters. Technol. Forecast. Soc. Chang. 2018, 127, 8–22. [Google Scholar] [CrossRef]

- Falcone, P.M.; Morone, P.; Sica, E. Greening of the financial system and fuelling a sustainability transition: A discursive approach to assess landscape pressures on the Italian financial system. Technol. Forecast. Soc. Chang. 2018, 127, 23–37. [Google Scholar] [CrossRef]

- Falcone, P.M.; Sica, E. Assessing the opportunities and challenges of green finance in Italy: An analysis of the biomass production sector. Sustainability 2019, 11, 517. [Google Scholar] [CrossRef]

- Bartolacci, F.; Paolini, A.; Quaranta, A.G.; Soverchia, M. Assessing factors that influence waste management financial sustainability. Waste Manag. 2018, 79, 571–579. [Google Scholar] [CrossRef]

| Product | Number of Shops | Total Disposal | Total Sales | Price (yen) |

|---|---|---|---|---|

| frankfurter sausages A | 11 | 6030 | 22,200 | 150 |

| frankfurter sausages B | 8 | 2670 | 4291 | 150 |

| frankfurter sausages C | 2 | 635 | 1970 | 150 |

| french fries A | 22 | 8532 | 21,653 | 155 |

| french fries B | 25 | 11,939 | 30,350 | 155 |

| french fries C | 2 | 921 | 2615 | 165 |

| fried chicken A | 72 | 40,140 | 171,193 | 165 |

| fried chicken B | 33 | 17,098 | 152,790 | 105 |

| fried chicken C | 10 | 4464 | 14,869 | 105 |

| grilled chicken A | 3 | 1164 | 3075 | 105 |

| grilled chicken B | 12 | 4253 | 8651 | 105 |

| grilled chicken C | 13 | 4873 | 19,272 | 105 |

| potato croquette | 1 | 452 | 759 | 80 |

| skewered beef | 1 | 297 | 331 | 120 |

| (Total number) | 215 | 103,468 | 454,019 | - |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sakoda, G.; Takayasu, H.; Takayasu, M. Data Science Solutions for Retail Strategy to Reduce Waste Keeping High Profit. Sustainability 2019, 11, 3589. https://doi.org/10.3390/su11133589

Sakoda G, Takayasu H, Takayasu M. Data Science Solutions for Retail Strategy to Reduce Waste Keeping High Profit. Sustainability. 2019; 11(13):3589. https://doi.org/10.3390/su11133589

Chicago/Turabian StyleSakoda, Gen, Hideki Takayasu, and Misako Takayasu. 2019. "Data Science Solutions for Retail Strategy to Reduce Waste Keeping High Profit" Sustainability 11, no. 13: 3589. https://doi.org/10.3390/su11133589